If you’re under the impression that financial planning is ho-hum, you haven’t spoken with Melissa L. George. Melissa, the owner of Melissa L. George & Associates, is a multi-certified financial professional who is passionate about her work.

As a double minority in a white male dominated industry, she has carved out an impressive business by listening deeply to her customers and sticking to her principles.

Melissa didn’t have a straight path from college to the financial district, paved with a network of connections. Instead, she took nine years to work her way through college, taking classes when she had enough money, and pausing when she didn’t.

It was at Georgia State, studying to be an accountant, that she realized math alone would not satisfy her career aspirations. She loved everything about math but couldn’t envision a career stuck in an office immersed in spreadsheets. She needed more human interaction.

She had been working for the city of Atlanta, starting at age 16 as a lifeguard and pool manager, then going full-time with the city after she graduated from high school. In her mid-20s she took a job at Victoria’s Secret as a store manager, and there she made one very important connection. As she tells it, “One day, I was talking to the mall manager about what I was trying to do, how I was trying to figure out which career path would combine my love of math with my love of working with people. He said he had someone he wanted me to speak with.” He introduced her to another African-American woman with a successful career in financial planning; the woman who would recommend her for her first financial job and who would become her mentor.

Until that meeting, Melissa hadn’t been aware of financial planning as a career path. But it was a perfect fit for her business degree, her people skills, and her entrepreneurial spirit.

Melissa speaks of her first day as a financial professional; 30 years old and just 3 years out of college. “My first day of work I started with three other new hires: White men who were considerably older than me and already had careers. CPAs, engineers, they seemed like a more obvious fit for this profession.” Her new manager asked her “How are you going to get people to trust you? To trust that you know what you’re doing?” And Melissa admitted she wasn’t sure. She told her manager, “I’m going to be honest and forthcoming, and if I don’t know the answer to something, I’ll just say so and go find the answer.”

“And maybe I’ll start wearing glasses.”

Melissa quickly realized that her retail background was a strength. Her service orientation, skill at reading body language, and ability to quickly establish rapport with customers were all abilities she could lean on while she learned the ropes of budgeting, debt reduction, risk management, insurance, and retirement planning.

Her customers gained confidence in her as she gained confidence in herself. As she shared the information about how to become financially secure and independent with her customers, she was learning too. “I’m very transparent,” Melissa shares. “I have always shared the mistakes that I’ve made right alongside the best practices that I’ve learned. And that transparency is important, because as a financial professional, you work hard to earn trust.”

Melissa offers a funny and apt trust analogy. She says that a person will make an appointment with a doctor, and without so much as checking the doctor’s credentials or history, will go into that doctor’s office and “snatch all their clothes off.”

She goes on to say, “They’ve never met this person before, yet there they are with their feet in the stirrups. But they come to me and they are more guarded with their finances than with any doctor. So they give me a little information and a little money to work with, and I must earn some trust before they give me a little more information and a little more money to work with.” She understands their hesitancy. “I didn’t grow up with sound financial knowledge or education either. I understand the emotional attachment people have to their hard-earned money.”

When she had switched from retail to financial services, she went from a salary to pure commission. This put immense pressure on her ability to earn an income while learning an entirely new career. “That was scary — a big step” she says. It wasn’t smooth sailing and she struggled. But she chose to believe in herself, and her willingness to take risks and invest in herself has paid off again and again.

Melissa worked six years for that first firm, learning the ropes and building skills. “But I was a captive agent, which meant I was limited in the products I could offer my clients.” In her 7th year she became a detached agent, which gave her more freedom to select products and offer services that she thought her customers needed, and in 2006 she founded MLGA.

DITCH THE COOKIE CUTTER.

“I don’t believe financial plans can be cookie-cutter,” Melissa says. “I craft plans for people based on their situation. Some people have children to consider, others have elderly parents they care for, or a family member with special needs. And more and more, I am working with individuals who own businesses, and we start by working on personal financial plans and then go on to work on business needs, operations and HR, and succession plans. Everyone’s situation is different.”

Ask Melissa about her personal family and friend support network, and she refers to her constellation which is her support system that she’s built over the years. When she talks about how she has developed her business, you can see that she’s built that constellation around her customers too. MLGA is a boutique firm with a powerful network of strategic partners.

“I wanted to provide portfolio services, but to give the best possible advice you have to be glued to a computer screen monitoring the markets.” So, she formed a partnership with a company that only does portfolio management. She went on to create other partnerships that offer tax and legal services. Today she works with estate planning attorneys, CPAs, enrolled agents, and a wide variety of industry experts. “I want my customers to have the best financial advice there is,” so she’s assembled a network of specialists, all at the top of their game.

This commitment to putting the customer first is evident in Melissa’s professional development choices as well. She has chosen to be a Certified Financial Fiduciary (CFF), which means she is legally obligated to put her clients’ financial interests above her own, and that she must disclose how she is compensated to avoid conflicts of interest in her recommendations. She is also a FINRA arbitrator, helping to resolve disputes between the investing public and the securities industry. Achieving these professional designations speaks to Melissa’s philosophy and ethical standards.

Any conversation with Melissa includes frequent use of the word journey. College was a journey. Learning financial planning has been – and continues to be – a journey. Marriage? Ask her about marriage and you’ll get a chuckle out of her.

“I’ve been married before,” she says. “I genuinely believe in marriage, and I’m willing to try it again, but if it’s not right, I don’t have a problem cutting the cord.”

If there is a next time around, which she would welcome, she knows she will do a better job of listening to her gut. “When I know someone has been divorced, I ask them, were there red flags? And there always were. There were for me too. We make decisions and we make mistakes. That’s all OK. We just have to learn from those mistakes, or we will continuously repeat.”

INVEST IN YOURSELF.

She says, “Now that I know myself well, I know my non-negotiables and deal-breakers; what I am willing and unwilling to compromise on.” So before committing again, Melissa plans to have a better handle on what the shared experience will look like. “How does a person respond when the bottom falls out? How do they treat their mother, sisters, and women in general? How are they with money management? How do they behave when they are sick? There are all these seasons you go through with someone in a long-term relationship. I think it’s important to date long enough to go through several seasons and pay attention to how each one is handled.”

The season of the pandemic has been particularly challenging for Melissa. Since the beginning of 2019 she dissolved a significant relationship, her father died unexpectedly, she moved her mother in to live with her, the pandemic started, and both she and her mother have had surgeries.

And during all that trauma, what Melissa decided to do was reclaim her health. “With the help of my personal trainer, I lost 60 pounds and I kept it off. I’m an avid runner. I work out, I eat well, and I’m serious about being healthy.”

“I know how I want to ride out the 2nd half of my life.” she declares. “I don’t want to be one of those people on medications, hunched over, can’t travel. I plan to live long, be a Centenarian. But I know the next breath is not promised, so I’m making the most of my life every day.”

When asked to provide some advice to her younger self, Melissa says, “surround yourself with people who genuinely care about your well-being and listen to your inner voice. We have this innate spirit of discernment that God put that in us, and we need to learn to harness that. Build a strong inner circle. Mine is made up of my family, my lifelong friends, my sorority sisters. I know they are here for me, and I’m here for them. That’s everything. I’m Blessed!”

She continues, “Also, don’t compare yourself to others. Don’t get caught up on where you’re supposed to be or to have accomplished by the time you’re a certain age. I didn’t understand that until I got much older why my trajectory had to be so different. But now I know that God’s plan for each of us is unique…God gives us exactly what we need to grow. So just pay attention to your own path, and the lessons you need to learn to graduate from one level to the next.”

Like the glasses she initially put on to convey confidence, but which she ultimately grew into, Melissa L George is a study in becoming what you set out to be. For her, financial planning is not just about the math, nor is it just about the money. It’s about relationships and the opportunity to make a difference in people’s lives. It’s about the journey.

Melissa L. George & Associates, www.melissalgeorge.com.

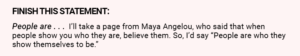

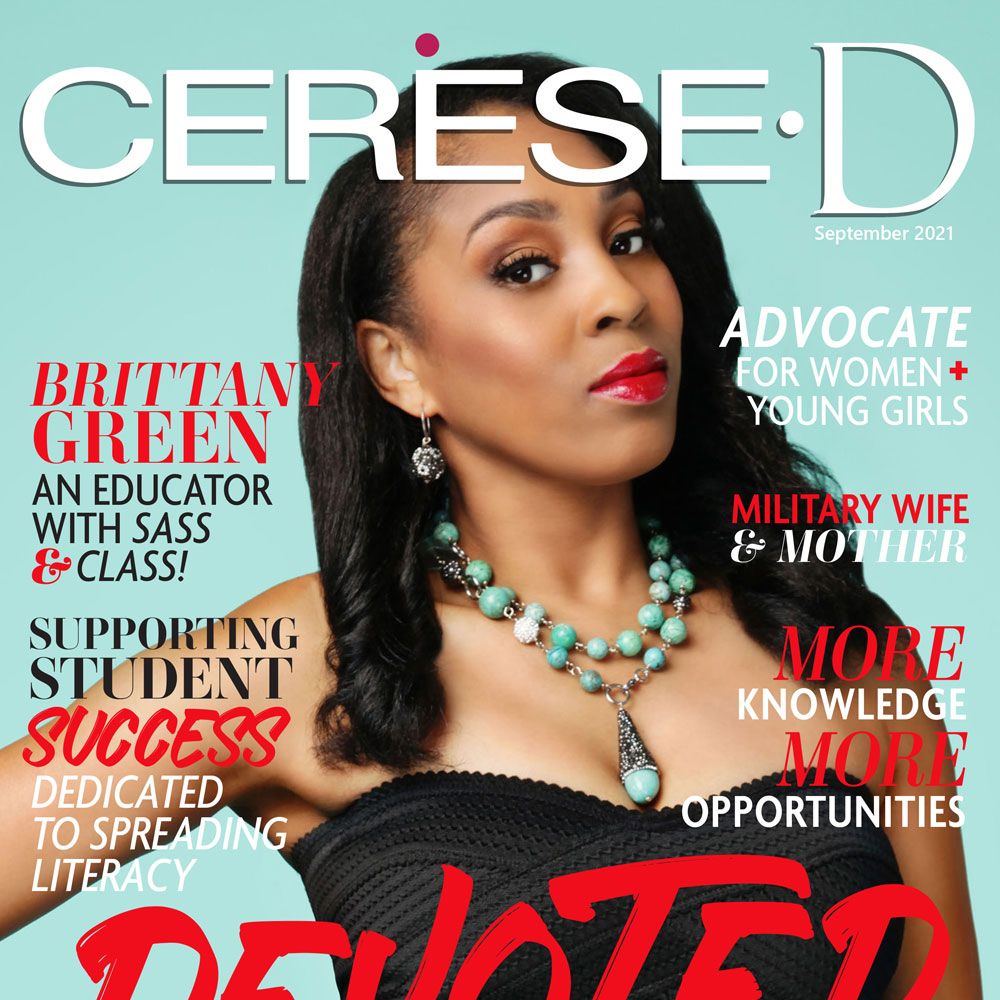

educator with fifteen years of experience ranging from classroom teaching to district level administration. Dedicated to improving student learning outcomes, Brittany is the co-creator of “Bridging the Gap for Struggling Adolescent Readers”, a professional development series for teachers of students with reading difficulties. Additionally, she is the author of “Therapeutic Approaches to the Treatment of ADD/ADHD”, a published research study.

educator with fifteen years of experience ranging from classroom teaching to district level administration. Dedicated to improving student learning outcomes, Brittany is the co-creator of “Bridging the Gap for Struggling Adolescent Readers”, a professional development series for teachers of students with reading difficulties. Additionally, she is the author of “Therapeutic Approaches to the Treatment of ADD/ADHD”, a published research study. When she is not in the classroom, Brittany is busy designing and creating for business clients, universities, and non-profits. She is the owner of Classy Creations Studio, a freelance graphic design and branding agency that services fempreneurs and small business owners. As the owner, she leads and manages the overall operations of the company. She is also the co-founder of The Profound Brown, an organization empowering young women and men through literacy. She also serves as an Adolescent Literacy Coach and Research Consultant supporting middle and high school scholars across the nation.

When she is not in the classroom, Brittany is busy designing and creating for business clients, universities, and non-profits. She is the owner of Classy Creations Studio, a freelance graphic design and branding agency that services fempreneurs and small business owners. As the owner, she leads and manages the overall operations of the company. She is also the co-founder of The Profound Brown, an organization empowering young women and men through literacy. She also serves as an Adolescent Literacy Coach and Research Consultant supporting middle and high school scholars across the nation.

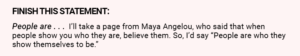

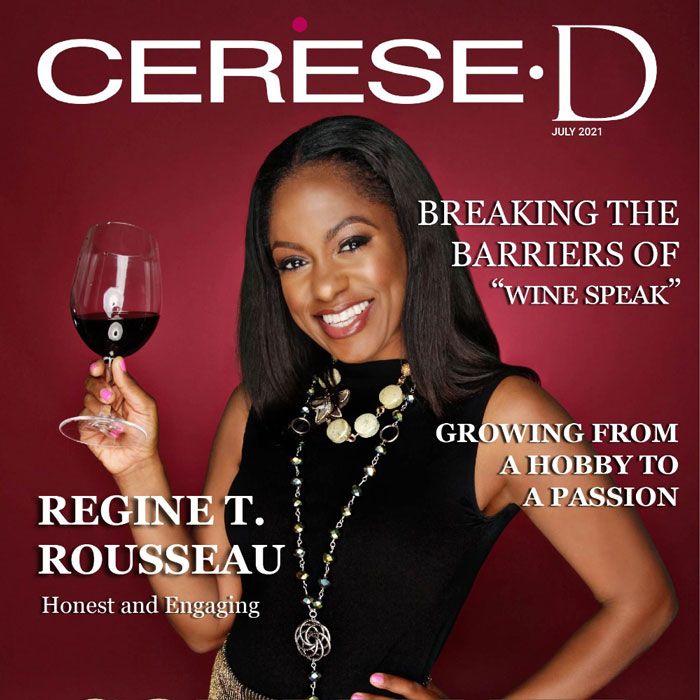

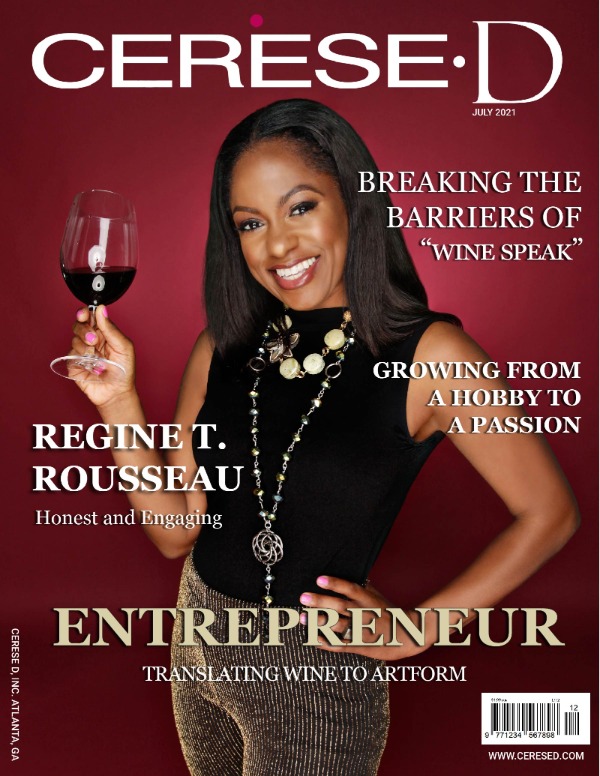

The wine industry has been historically known to be exclusive, white and male. To further cement the industry’s image, the Association of African American Vintners reports that only 50 out of the 10,000 U.S. wineries are Black-owned. That is equivalent to .05 percent of the wineries! But according to the Wine Market Council Consumer Segmentation, Black consumers make up about 11 percent of wine drinkers in the country. While the numbers may be dismal in ownership, our July cover model, Regine T. Rousseau is helping shatter the glass ceiling, or in this case uncorking the bottle for a savory glass of wine with her company, Shall We Wine.

The wine industry has been historically known to be exclusive, white and male. To further cement the industry’s image, the Association of African American Vintners reports that only 50 out of the 10,000 U.S. wineries are Black-owned. That is equivalent to .05 percent of the wineries! But according to the Wine Market Council Consumer Segmentation, Black consumers make up about 11 percent of wine drinkers in the country. While the numbers may be dismal in ownership, our July cover model, Regine T. Rousseau is helping shatter the glass ceiling, or in this case uncorking the bottle for a savory glass of wine with her company, Shall We Wine.

Language is integral to Rousseau’s work as a poet and published author where wine and written word are often interwoven. In her book Searching for Cloves and Lilies: The Wine Edition, Regine illustrates the dynamics of personal relationships while pairing each poem with wine that echoes the mood of her writing.

Language is integral to Rousseau’s work as a poet and published author where wine and written word are often interwoven. In her book Searching for Cloves and Lilies: The Wine Edition, Regine illustrates the dynamics of personal relationships while pairing each poem with wine that echoes the mood of her writing.